Written by Luqman Hussien

Traders often face losses when they attempt to sell their produce in the agricultural value chain. This is especially true for traders in the fresh produce market. 4 of the key reasons contributing to this include:

- Seasonality: during the low season, prices from off-takers and middlemen are hiked, this implies that traders need to pass on these costs to buyers, reducing demand for the crop. Low seasonality is often paired with harsh weather conditions, this is often harsh sunlight, resulting in the reduced freshness of the produce.

- Produce quality: fresh produce is prone to depreciate in value over time, this is true especially for produce like cabbages with high water content. Instances of produce quality loss can occur within hours especially if the produce took time to get to the market paired with unfavourable weather conditions.

- Information asymmetry: uninformed traders can purchase from off-takers at high prices if uninformed of recommended market prices. Similarly, walk-in buyers might haggle for extremely low prices reducing the trader’s margins.

- Buyer demand: if demand is lower than anticipated, traders have no option but to lower their prices, in extreme cases, prices might go lower by almost 80%.

These are some of the key factors driving trader losses when trading agricultural produce. Needless to say, traders often estimate these factors and have no reliable source of past/current information to assist them in approximating the right price to buy or sell their produce for.

Amana Market’s Market Maker Model

At CoAmana, through our Amana Market platform, we piloted a market maker model as an attempt to inform traders on prices to sell to buyers. This model was implemented to achieve the following objectives:

- To communicate standard selling price for buyers prior to a transaction, have an informed buyer and seller in the market

- To minimize the friction that stems from negotiations, leading to dissatisfied trading parties.

Implementation

The team at Amana Market piloted this model at City Park Market Nairobi, with traders selling cabbages. The model was implemented in the following manner:

- We onboarded the traders that were interested in the model

- The traders then communicated their selling prices through our agent network

- The mean price for the cabbages was then computed and we bought a % of the traders stock supply

- The traders held the stock and sold at our recommended selling price based on demand and supply, this was revised based on market prices at regular time intervals.

What did we learn?

- Fresh produce loses value quickly, the traders needed to clear their stock as soon as possible in order not to face losses tied to the loss of product value.

- Traders only agree on prices at the time of stock purchase from off-taker, while traders do not exclusively coordinate on prices they will sell at, they tend to coordinate during market opening the prices they will sell the produce at.

- Supply influx/scarcity in the market can cause extreme price swings, the daily prices are affected by the supply of produce to the market. When off-takers offload a lot of produce in a particular market, there is a noticeably higher trade price

- Overall, fresh produce value declines quickly and there is a clear need to match demand and supply in the respective markets.

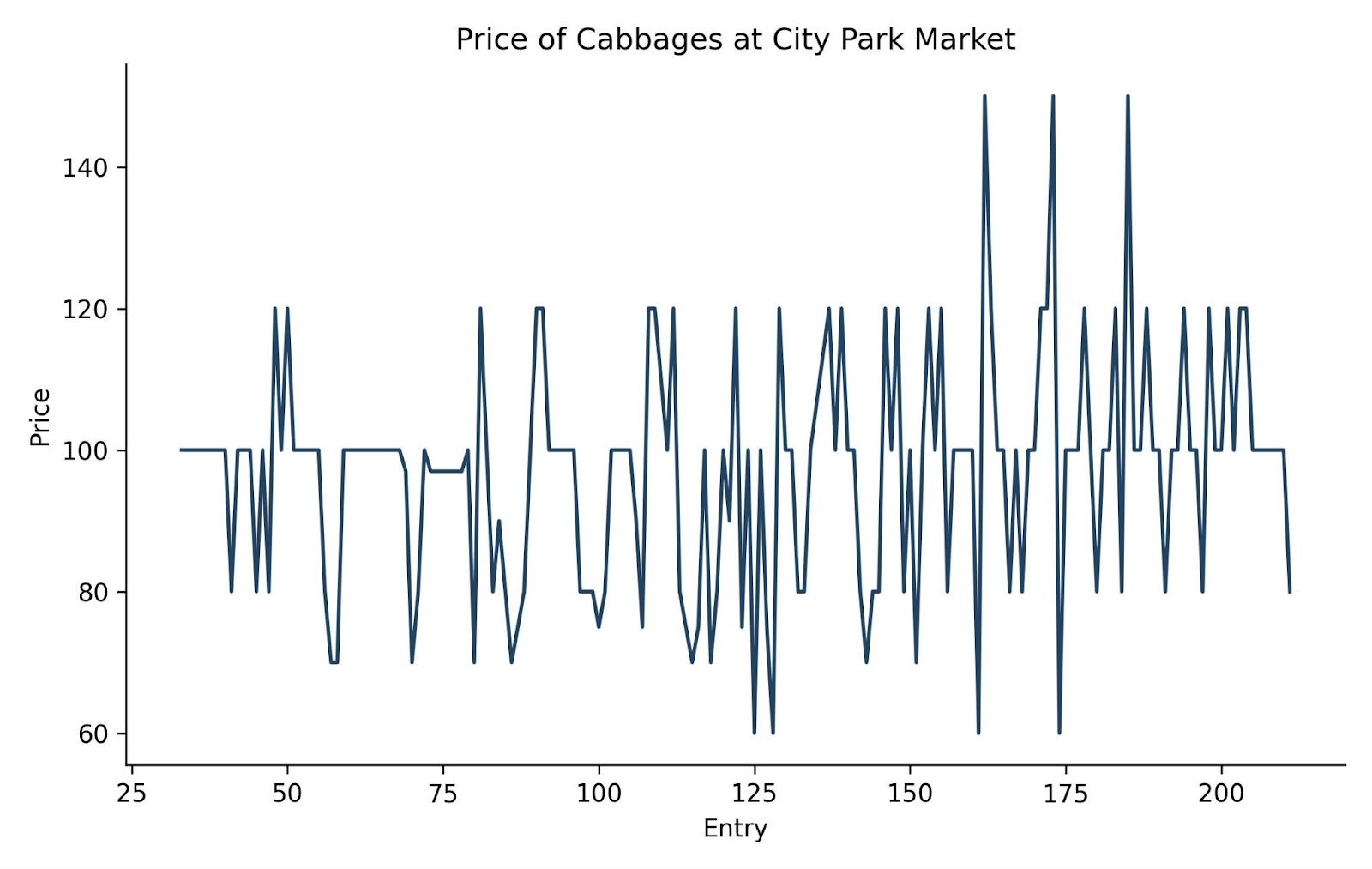

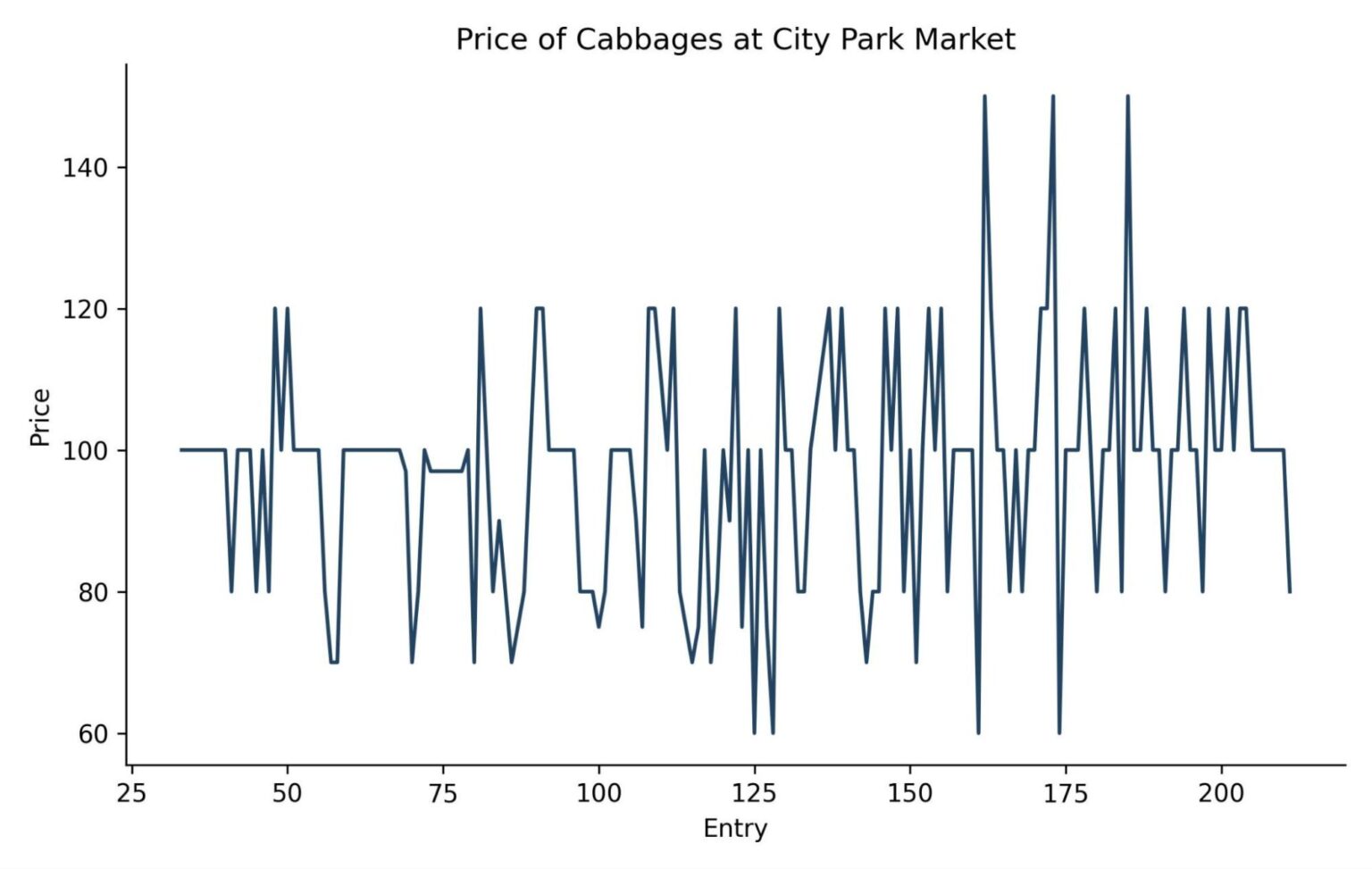

The graph below summarizes the swings in the market tracked over a period of time.